Lowest Premium

$315 / YEAR

Average Premium

$553 / YEAR

Highest Premium

$1000 / YEAR

The average annual premium in Laredo is around $553 and can go upto $1000. This is for a 30 year old female buying 50/100/50 coverage which is considered as the minimum liability.

Texas Car Insurance Minimum Requirement by Law

As per the Department of Public Safety in the state requires a minimum of 30/60/25 as explained below:

- $30,000 coverage for all types of bodily injury suffered by one individual in one accident

- Bodily injury suffered by two or more people is $60,000. The amount is the same for deaths of two or more people caused by one accident

- Damage to property or injury to others in one accident is $25,000.

It is legally mandatory to have car insurance in Laredo city. There are more than a dozen insurers in the city that offer car insurance. A full coverage car insurance in Laredo costs an average of $1,600. This is very high compared to the state average car insurance which is around $1,200. The most expensive car insurance in Laredo comes around $2,370. The car insurance for teenage drivers can go even higher in the city.

Jump to Topic:

Best Car Insurance Companies in Texas and Rates Offered

The cheapest car insurance rates in the state is provided by Geico Insurance followed by Farmers Insurance. But the major players are State Farm, Progressive and Farmers insurance in order.

| Company | Annual premium (50/100/50) | Market share | Complaints |

|---|---|---|---|

| Geico | $350 | 6.00% ($1,151,485,019) | 1 |

| Farmers | $385 | 7.98% ($1,530,613,603) | 2 |

| State Farm | $390 | 16.03% ($3,074,590,659) | 119 |

| Allstate | $495 | 7.38% ($1,416,050,038) | 4 |

| Liberty Mutual | $550 | 4.36% ($836,938,040) | 64 |

| Progressive | $660 | 8.75% ($1,678,264,745) | 0 |

Get a free quote from the best of 200+ companies in 90 seconds.

Find affordable car insurance in your city

We recommend you to get car insurance quote and compare rates before choosing an insurance plan. People save up to 50% on car insurance by using our comparison shopping.

Car Insurance Rates in Laredo by ZIP codes

The table below lists the average insurance rates for 50/100/50 (minimum liability) accross the zip codes in Laredo. We have omitted the zip codes that has same insurance rates. If your zip code is not listed in the table, please refer to the zip code near to you since the insurance rates will be same as of the neighbouring zip code.

| Zip | Avg. Premium |

|---|---|

| 78040 | $534 |

| 78041 | $543 |

| 78042 | $585 |

| 78043 | $552 |

| 78045 | $530 |

| 78046 | $545 |

Insurance Agents in Laredo, TX and Near by

-

0 miJesus Lopez719 Chihuahua St Ste 108, Laredo, TX 78040(956) 728-8851View |

-

0 miProtection Insurance Agency1020 Washington St Ste F, Laredo, TX 78040(956) 723-9542View |

-

0 miGlobalGreen Insurance Agency1519 Washington St Ste 101b, Laredo, TX 78040(210) 286-3704View |

-

0 miMedina Wright Insurance2212 N Seymour Ave, Laredo, TX 78040(956) 723-5546View |

-

0 miInsurance Quotes1820 San Bernardo Ave, Laredo, TX 78040(956) 727-8881View |

-

0 miCavazos Insurance Agency2107 San Bernardo Ave, Laredo, TX 78040(956) 723-4623View |

-

14.99 miEdgar Gonzalez2702 Jaime Zapata Hwy Ste 1, Laredo, TX 78043(956) 284-0111View |

-

14.99 miGonzalez Insurance Agency3911 Jaime Zapata Memorial Hwy Ste 4, Laredo, TX 78043(956) 723-7600View |

-

14.99 miSafeguard Insurance Agency4205 Jaime Zapata Memorial Hwy Ste 23, Laredo, TX 78043(956) 791-7272View |

-

14.99 miRaul R. Martinez Jr.3802 Hwy 359 Ste 5, Laredo, TX 78043(956) 729-8884View |

-

14.99 miAlphasure Affordable Insurance Services1620 Chihuahua St, Laredo, TX 78043(956) 729-9500View |

-

14.99 miManuel Gomez III4311 Clark Blvd Ste K, Laredo, TX 78043(956) 333-0000View |

-

14.99 miHerman Dominguez3120 N Arkansas Ave, Laredo, TX 78043(956) 726-0493View |

-

14.99 miSandra Zimmerman Insurance3515 N Arkansas Ave Ste 107, Laredo, TX 78043(956) 796-1115View |

-

25.39 miGabriel Medina9807 Mines Rd Ste 6, Laredo, TX 78045(956) 645-2510View |

-

25.39 miDelgado Insurance Agency9902 Mcpherson Rd Ste 6, Laredo, TX 78045(956) 415-0276View |

-

25.39 miAmericorp Insurance Group408 Shiloh Dr Ste 3, Laredo, TX 78045(956) 568-3667View |

-

25.39 miJorge A. Monsivais414 Shiloh Dr Unit 1, Laredo, TX 78045(956) 722-0087View |

-

25.39 miCarlos Nunez Jr1102 Marshall St Ste 3, Laredo, TX 78045(956) 763-2707View |

-

25.39 miKike Trevino517 Shiloh Drive Ste 4, Laredo, TX 78045(956) 791-5453View |

-

25.39 miCV Insurance1001 Queens Ct, Laredo, TX 78045(956) 206-1026View |

-

25.39 miManuel Benavides8610 Mcpherson Rd Ste 100, Laredo, TX 78045(956) 725-5952View |

-

25.39 miFalcon Bank Insurance7718 Mcpherson Rd, Laredo, TX 78045(956) 794-9700View |

-

25.39 miKevin Romo7917 Mcpherson Rd Ste 208, Laredo, TX 78045(956) 753-9337View |

-

3.69 miAmerica Insurance Agency7128 Rosson Ln Ste 10, Laredo, TX 78041(956) 717-1500View |

-

3.69 miPowell-Watson Insurance Group6301 Arena Blvd, Laredo, TX 78041(956) 764-4399View |

-

3.69 miMike Cortez201 W Del Mar Blvd Ste 16, Laredo, TX 78041(956) 723-6453View |

-

3.69 miMario Guzman Jr216 W Village Blvd Ste 102, Laredo, TX 78041(956) 242-0333View |

-

3.69 miLuis Cardenas1418 E Saunders St Ste 1, Laredo, TX 78041(956) 726-8944View |

-

3.69 miManuel Benavides4001 Mcpherson Ave Ste 105, Laredo, TX 78041(956) 725-5901View |

-

3.69 miSouth Texas Insurance Agency4815 San Bernardo Ave, Laredo, TX 78041(956) 729-1010View |

-

3.69 miBeto Gonzalez502 W Calton Rd Ste 104, Laredo, TX 78041(956) 726-0547View |

-

3.69 miHector Chapa317 E Calton Rd Ste 5, Laredo, TX 78041(956) 568-1003View |

-

3.69 miSafeguard Insurance Agency104 E Calton Rd Ste 101, Laredo, TX 78041(956) 242-6989View |

-

3.69 miMarcus Moreno709 E Calton Rd Ste 106, Laredo, TX 78041(956) 723-8591View |

-

3.69 miPena Insurance220 W Hillside Rd Ste 11, Laredo, TX 78041(956) 724-9004View |

-

3.69 miRicardo Rodriguez5411 Mcpherson Rd Ste 101, Laredo, TX 78041(956) 726-1906View |

-

3.69 miKeefe Duterte709 Alta Vista Dr Ste 101, Laredo, TX 78041(956) 726-4649View |

-

3.69 miBruno Diaz107 Calle Del Norte Ste 1c, Laredo, TX 78041(956) 774-6290View |

-

3.69 miAnabella Ruiz Herbig315 Calle Del Norte Ste 103, Laredo, TX 78041(956) 725-1617View |

-

3.69 miStonebriar Insurance Group5711 Mcpherson Rd Ste 202, Laredo, TX 78041(956) 729-0799View |

-

3.69 miPedro Sanchez5916 San Bernardo Ave, Laredo, TX 78041(956) 722-8445View |

-

3.69 miRaul Patino5901 Mcpherson Rd Ste 6b, Laredo, TX 78041(956) 728-1828View |

-

3.69 miTexas Farm Bureau Insurance1505 Calle Del Norte Ste 210, Laredo, TX 78041(956) 712-3276View |

-

3.69 miCubriel Insurance Agency6010 Mcpherson Rd Unit D2, Laredo, TX 78041(956) 568-5290View |

-

3.69 miGSM Insurors6019 Mcpherson Rd Ste 10, Laredo, TX 78041(956) 724-9100View |

-

3.69 miBeverly Hagy6019 Mcpherson Rd Ste 6, Laredo, TX 78041(956) 717-5770View |

-

3.69 miAschere Insurance Group6108 Mcpherson Rd Ste 8, Laredo, TX 78041(956) 790-0155View |

-

3.69 miHenri D Kahn Insurance Services112 Del Ct Ste B, Laredo, TX 78041(956) 725-3936View |

-

3.69 miCynthia Cardenas6909 Springfield Ave Ste 103, Laredo, TX 78041(956) 724-8200View |

-

3.69 miJuan Sanchez6909 Springfield Ave Ste 104, Laredo, TX 78041(956) 791-6511View |

-

3.69 miRobert Rogers6410 Mcpherson Rd Ste 2, Laredo, TX 78041(956) 724-1038View |

-

3.69 miDelhia Baber1705 E Del Mar Blvd Ste A114, Laredo, TX 78041(956) 753-3773View |

-

3.69 miRene Benavides8218 Casa Verde Rd A-5, Laredo, TX 78041(956) 723-9511View |

-

3.69 miLuis Estrada3660 E Del Mar Blvd Ste 9, Laredo, TX 78041(956) 568-8013View |

Learn More About Car Insurance in San Antonio, TX

Population

261,500

Total Crashes

5,576

Persons Injured

1,547

Car Insurance in Laredo is cheaper compared to other major cities in Texas. But be cautious when choosing car insurance and add enough coverage to protect you from any lawsuits for a car accident that you caused. There are more than a dozen insurance companies operating in Laredo. Some are popular and have the majority share of the market. There are lesser known insurers that may have more reasonable premiums for similar coverage but you should take a holistic view of all your options. You need a convenient process, assured approval of claims and responsiveness on the part of your insurer so you don’t have to run to and fro with your applications, filing of damages and other imperative procedures.

Check this article to know what all types of coverages you need for car insurance.

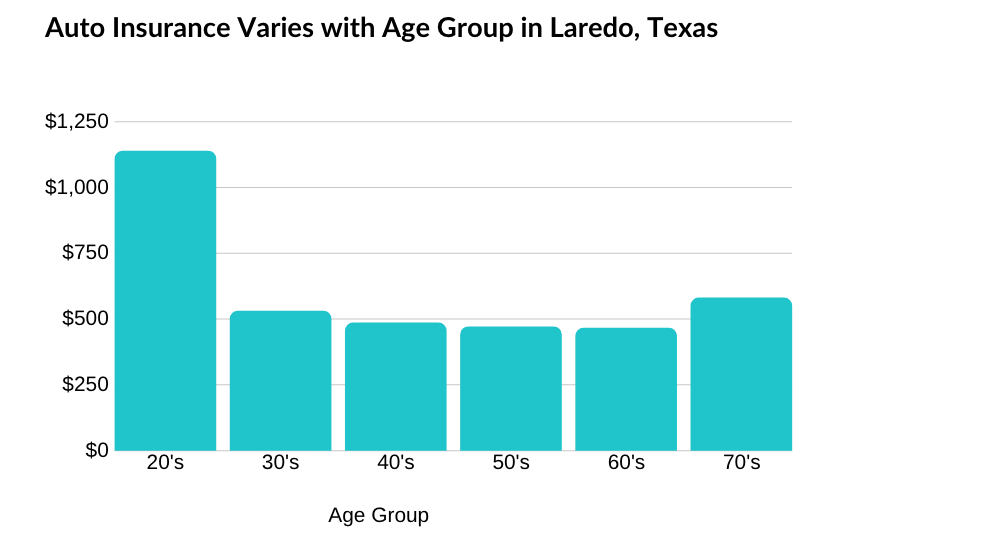

Car insurance vary by age group

The age group you are in can influence the car insurance premium. You can see how much car insurance costs for different age groups in Laredo city.

| Age group | Avg. Premium (50/100/50) |

|---|---|

| 20's | $1,135 |

| 30's | $530 |

| 40's | $485 |

| 50's | $470 |

| 60's | $465 |

| 70's | $580 |

From the graph above, we can see that the insurance premium cost is very high for those in their 20's as the risk of accident is higher in that age group. Similarly for those who passed their 70's also tends to be at higher risk of collision and hence a higher premium amount.

Also you can see a slight difference in car insurance premium cost with respect to your gender as female drivers tends to pay less for their car insurance. This variation is seen more in the 20's age group.

Age is just one of the factors that effects your car insurance price. Check the article below to know what other factors are there.

The choice of insurer will also have a substantial influence on the cost. It is needless to mention that the cheapest quote is not always the best and the most expensive policy is not always the ideal option. There are some insurers that are more convenient to deal with and some are more affordable, some are lenient and easy with claims while some are more suited for families of deployed military personnel. You should have a diligent approach while choosing car insurance in Laredo. Figure out how much coverage you would need based on the value of your car, driving skills, frequency of usage including the mileage and routes, your history of accidents and the extent of financial protection you want.

Helpful Info on Texas Car Insurance

Here is a list of useful information regarding Texas car insurance and driving in Texas roads.

| Total vehicles registered | 24,527,939 |

| Total uninsured motorists | 14.1% |

| Estimated economic loss of all vehicle crashes | $38.4 billion |

Sources: uninsured motorists, 2015, crash report, 2018

Different car insurance coverage options available in Texas

There are different coverages to protect your family and your car in the event of an accident. It is always better to have enough coverage to not incur any loss in such scenarios. Below is a list of coverages available in Texas state.

- Liability covers for the payment to other car driver and car met by accident caused by you. Texas law requires you to have at least 30/60/25 coverage. This will cover for injuries $30,000 per person and $60,000 per accident. It also covers for property damage up to $25,000. It is better to have enough coverage than just having the minimum required 30/60/25 coverage to make sure all the losses are covered with your insurance.

- Collision covers for the expenses on your car caused by accident.

- Comprehensive covers your car cost if your car is stolen or damaged by fire, flood, vandalism.

- Medical payments cover your's and your passenger's medical bills

- Personal injury protection (PIP) coverage is similar to medical payments coverage but also covers for the loss of pay and other non-medical expenses caused by accident.

- Uninsured/underinsured motorist covers for the damage to you and your car caused by an uninsured or underinsured motorist. This is required in Texas, but you can opt-out from this coverage.

- Towing and labor covers for the pay for towing your car and labor cost.

- Rental reimbursement covers the payment for rental car service used when your car which had an accident is being repaired.

Methodology

The insurance rates mentioned in this article is based on the average amount for a 30 year old female purchasing 50/100/50 ($50,000 for injury liability for one person, $100,000 for all injuries and $50,000 for property damage in an accident) liability car insurance coverage. The premium rate can be higher or lower than the rates specified depending on the type of coverage one may choose, deductibles applied and the discounts offered by insurance company.